Get stories and expert advice on all things related to college and parenting.

Have you been working and now think it's a good time to advance your career by getting a degree? Or are you the parent of a high school graduate who's postponed college but now wants to head in that direction?

Going back to school may sound like a great idea until you see the price tag. Most colleges and universities cost tens of thousands of dollars a year, while community colleges may rack up a smaller bill.

Then there is the everyday cost of living. Each semester, you'll need to pay for groceries, rent, textbooks and cover various other bills, too.

While you can take out student loans to work towards your biggest goals, most people don't want to finance their whole education with borrowed money. Going back to school can help you take that next step in your career, but there are some tips and tricks to getting ahead and budgeting for this next big step.

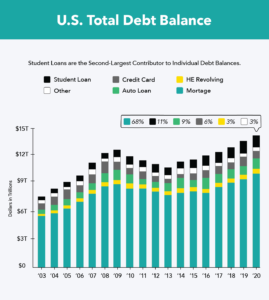

As of right now, student loans make up 11 percent of the U.S. debt, surpassing auto loans and credit card debt. While this may not sound that drastic, it comes into perspective if you personally know a lot of people who have student debt up to their ears.

Instead of having to pay your own student debt for years after graduation, you may want to work hard in order to save so you'll be able to foot the bill yourself.

You have options when it comes to building your savings. To decide which is the right path for you or a loved one, begin by evaluating degree plans and school preferences. From there, start contributing as much as you can each month.

Not only will paying your tuition with your own hard-earned money feel great, but you may value your experience in school that much more.

Click here to read Mint's "How to Save for College: The Ultimate Guide for Parents and Students" >

Kayla Montgomery is a digital content marketer who helps Mint create helpful and compelling stories worth sharing. Her background in digital marketing and creative writing has led her to cover unique topics ranging from business to lifestyle. In her spare time, she enjoys working out, writing for her own blog, traveling, and exploring all the in’s and out’s Austin, TX has to offer. To learn more, connect with Kayla on LinkedIn.

Kayla Montgomery is a digital content marketer who helps Mint create helpful and compelling stories worth sharing. Her background in digital marketing and creative writing has led her to cover unique topics ranging from business to lifestyle. In her spare time, she enjoys working out, writing for her own blog, traveling, and exploring all the in’s and out’s Austin, TX has to offer. To learn more, connect with Kayla on LinkedIn.